Helpful Tax Tips For Gig Workers

Earned Income Tax Credit Toolkit

What is the Earned Income Tax Credit?

- A refundable tax credit that provides greater economic security for working families, especially those with children.

- Created in 1975, it’s become the federal government’s most successful antipoverty programs.

The EITC puts more of your earned income back in your pocket — up to $6,728.

Self Employed and Gig Workers Can Still Claim the Earned Income Tax Credit!

You’re Self-Employed If:

- You carry on a trade or business as a sole proprietor or an independent contractor.

- You are a member of a partnership that carries on a trade or business.

- You are otherwise in business for yourself (including a part-time business)

You’re A Gig Worker If:

- You earn income providing on-demand work, services, or goods. Often, it’s through a digital platform like an app or website.

Income earned from gig work is still taxed — but you can get a portion of your money back through the Earned Income Tax Credit (EITC).

You’re Self-Employed If:

- You carry on a trade or business as a sole proprietor or an independent contractor.

- You are a member of a partnership that carries on a trade or business.

- You are otherwise in business for yourself (including a part-time business)

You’re A Gig Worker If:

- You earn income providing on-demand work, services, or goods. Often, it’s through a digital platform like an app or website.

Income earned from gig work is still taxed — but you can get a portion of your money back through the Earned Income Tax Credit (EITC).

Do You Qualify For The EITC?

- The EITC is based on your earned income — wages, tips, money from self-employed work, and some disability benefits.

- Income from self employment or gig work still counts as earned income towards the EITC.

- Unemployment does not count towards your earned income. You can still claim the EITC even if you collected unemployment in the same year as you earned income.

- Business expenses for gig workers are deducted from gross income to arrive at the adjusted gross income which is used to calculate eligibility for the EITC.

- The Earned Income Credit is only available if your adjusted gross income, or AGI, is less than the applicable maximum for the tax year. The applicable maximum AGI depends on your filing status and the number of qualifying children if any. See the chart below for more information.

| Children or relatives claimed | Maximum adjusted gross income (AGI) if filing as single, head of household, widowed, or married filing separately | Maximum AGI if filing as married filing jointly |

|---|---|---|

| Zero | $21,430 | $27,380 |

| One | $42,158 | $48,108 |

| Two | $47,915 | $53,865 |

| Three | $51,464 | $57,414 |

Resources For Tax Filing

The VITA program has operated for over 50 years. VITA sites offer free tax help to people who need assistance in preparing their own tax returns, including:

- People who generally make $58,000 or less

- Persons with disabilities

- Limited English-speaking taxpayers

The TCE program offers free tax help, particularly for those who are 60 years of age and older, specializing in questions about pensions and retirement-related issues unique to seniors.

Use the tool below to find the nearest volunteer tax assistance site in your area:

What Else Should I Know?

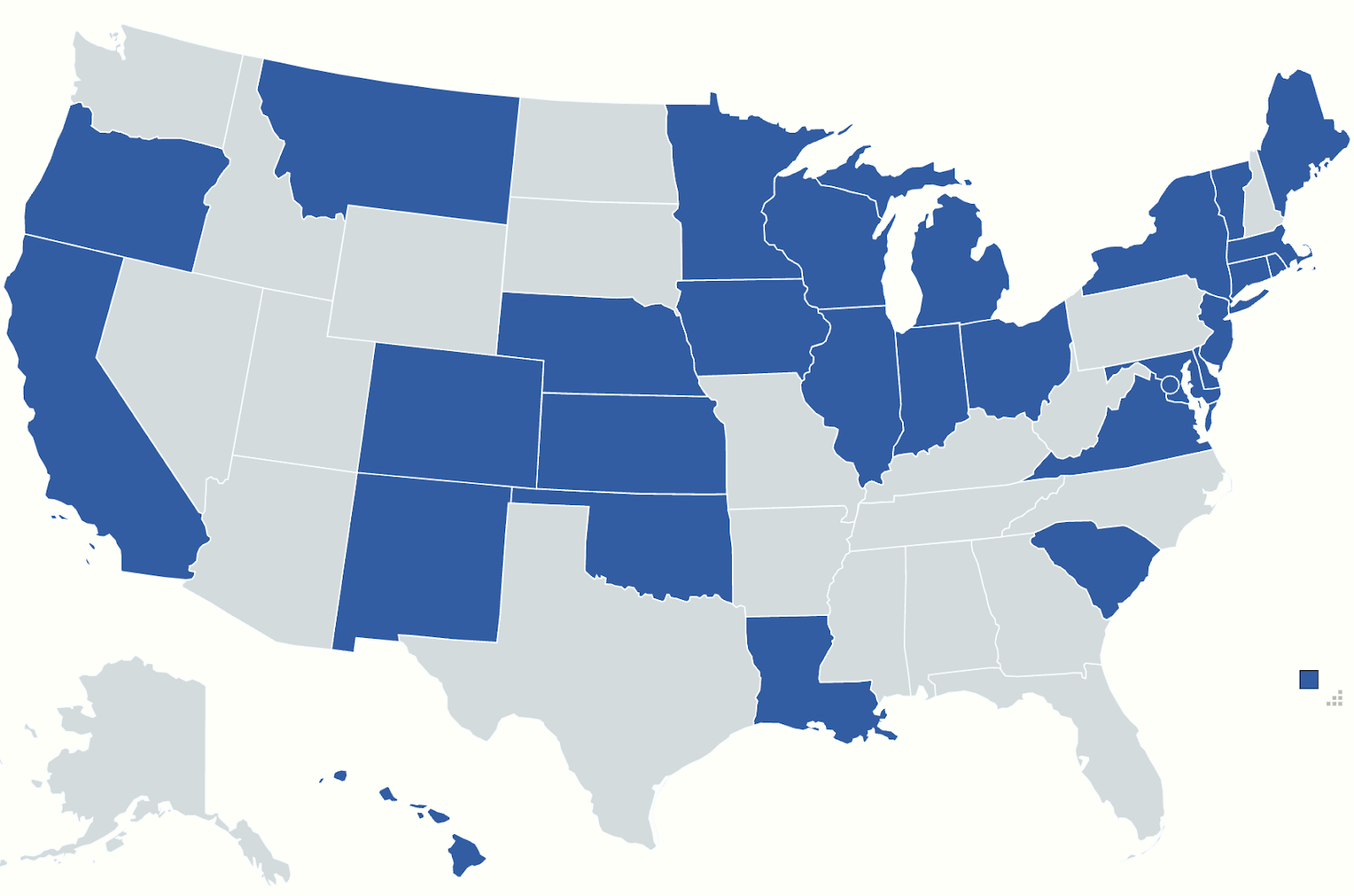

- If you qualify for the federal EITC, you may also be eligible for a similar credit from your local government. 28 states, the District of Columbia, and New York City offer residents an earned income tax credit. See if your state has its own EITC:

- If you qualify for the EITC, you may also qualify for the Child Tax Credit for 2021.

- You can download our full EITC Toolkit here. It’s available in English and Spanish.

Signup Form

Stay up-to-date on all of our resources for the self-employed and gig workers here